BJ255 Insights

Exploring the latest trends and news in various fields.

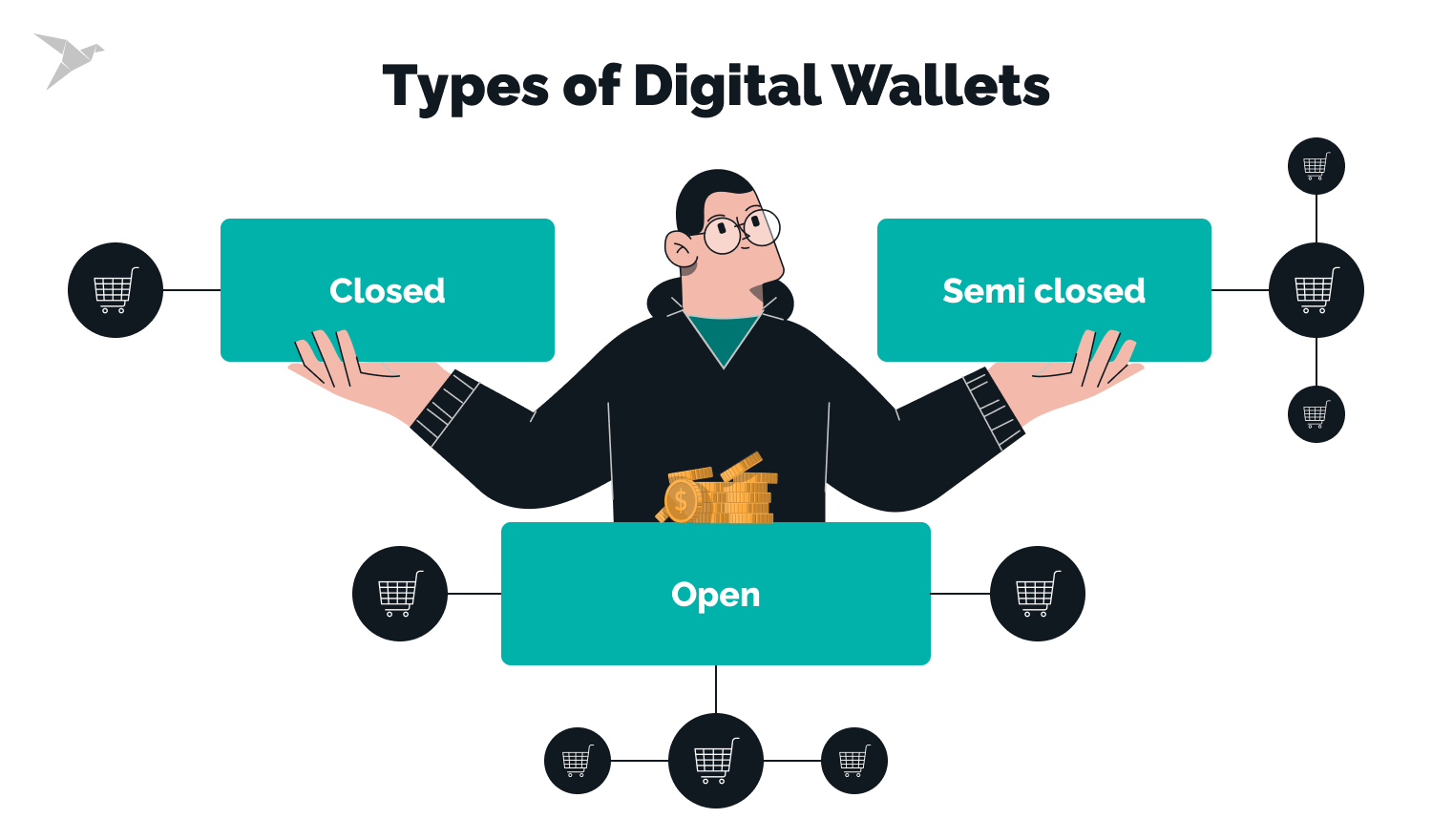

Ditch Your Change: How Digital Wallet Integrations Are Changing the Game

Discover how digital wallet integrations are revolutionizing payments. Ditch your change and embrace the future of finance today!

The Future of Payments: How Digital Wallets Are Making Cash Obsolete

As we move further into the digital age, digital wallets are transforming the way we handle transactions, making traditional cash payments increasingly obsolete. With the surge in mobile technology, these virtual wallets allow users to store their payment information securely and access it with just a few taps on their smartphones. This shift not only streamlines the checkout process but also enhances security, as many digital wallets utilize encryption and biometric authentication to protect user data. Furthermore, the integration of loyalty programs and instant cashback offers within these platforms incentivizes consumers to make the switch, fostering a cashless economy.

The benefits of using digital wallets extend beyond convenience and security. As they evolve, we see more features being incorporated, such as peer-to-peer transfers and international payments, facilitating seamless transactions across borders. According to recent studies, digital wallet usage is projected to increase significantly in the coming years, with a growing number of businesses accepting this form of payment. As we embrace this future, it becomes evident that cash may soon be regarded as a relic of the past, with digital wallets paving the way for an easier and more efficient financial landscape.

Counter-Strike is a highly popular tactical first-person shooter game that emphasizes team-based gameplay and strategy. Players can choose to be part of either the terrorist or counter-terrorist team, engaging in various mission objectives. Many gamers enjoy betting on esports events related to Counter-Strike, and you can enhance your betting experience by using a betpanda promo code for additional benefits.

Top 5 Benefits of Integrating Digital Wallets into Your Daily Life

Integrating digital wallets into your daily life can significantly enhance your payment experience. One of the primary benefits is the convenience they offer; with just a few taps on your smartphone, you can complete transactions without the need for cash or physical cards. Additionally, most digital wallets support multiple payment methods, allowing users to store credit, debit, and loyalty cards all in one place. This streamlining of options not only saves time but also helps you stay organized.

Another important advantage of using digital wallets is the added security they provide. Many digital wallets employ advanced security features, such as encryption and biometric authentication, to safeguard your financial information. This increased layer of security reduces the risk of fraud and identity theft, giving you peace of mind during transactions. Furthermore, digital wallets often include tracking features, helping you manage your spending and budget more effectively.

Are Digital Wallets the Key to a Cashless Society?

The rise of digital wallets has significantly transformed the way we conduct financial transactions, playing a crucial role in the movement towards a cashless society. These applications allow users to store their financial information securely, facilitating quick and easy payments without the need for physical cash. Services like Apple Pay, Google Wallet, and PayPal offer seamless integration with various platforms, making it easier for consumers and businesses alike to embrace digital payments. But are digital wallets truly the key to a cashless society? The answer lies in their convenience, security, and growing acceptance among merchants worldwide.

As more people shift toward using digital wallets, several factors indicate their potential to replace cash entirely. According to recent studies, over 60% of consumers prefer digital payments over cash due to the convenience and speed they offer. Furthermore, the global pandemic has accelerated this trend, as people seek contactless solutions to minimize physical interactions. If digital wallets continue to evolve and integrate with emerging technologies such as blockchain and cryptocurrency, they could pave the way for a future where cash is obsolete, making transactions not only easier but also safer for everyone involved.