BJ255 Insights

Exploring the latest trends and news in various fields.

Crypto Regulation Rollercoaster: What the Latest Twists Mean for Your Wallet

Discover the wild twists of crypto regulations and how they could impact your wallet! Stay informed and ahead in the crypto game!

How Recent Crypto Regulation Changes Impact Your Investment Strategy

Recent changes in crypto regulation have significantly reshaped the investment landscape for both seasoned and novice investors. Governments worldwide are increasingly recognizing the need to establish a regulatory framework that addresses the unique challenges posed by cryptocurrencies. These regulations not only aim to enhance consumer protection but also to prevent fraud and promote market integrity. For investors, understanding these regulatory shifts is crucial, as they can directly impact market dynamics, volatility, and the overall legitimacy of digital assets.

As you adjust your investment strategy, consider the following aspects of recent regulatory changes: transparency in reporting, compliance requirements, and the potential for increased taxation on gains. Additionally, regions with more favorable regulations may offer opportunities for growth, making it essential to stay informed. By embracing these changes and adapting your strategy accordingly, you can navigate the complexities of the crypto market more effectively and enhance your potential for long-term success.

Counter-Strike is a highly popular multiplayer first-person shooter game that pits two teams against each other: terrorists and counter-terrorists. Players can choose to compete in various game modes, such as bomb defusal and hostage rescue. For those looking to enhance their gaming experience, using a betpanda promo code can provide exciting bonuses and offers. The game features realistic weapons, strategic gameplay, and a vibrant esports scene, solidifying its place in gaming history.

What You Need to Know About Global Regulatory Trends in Cryptocurrency

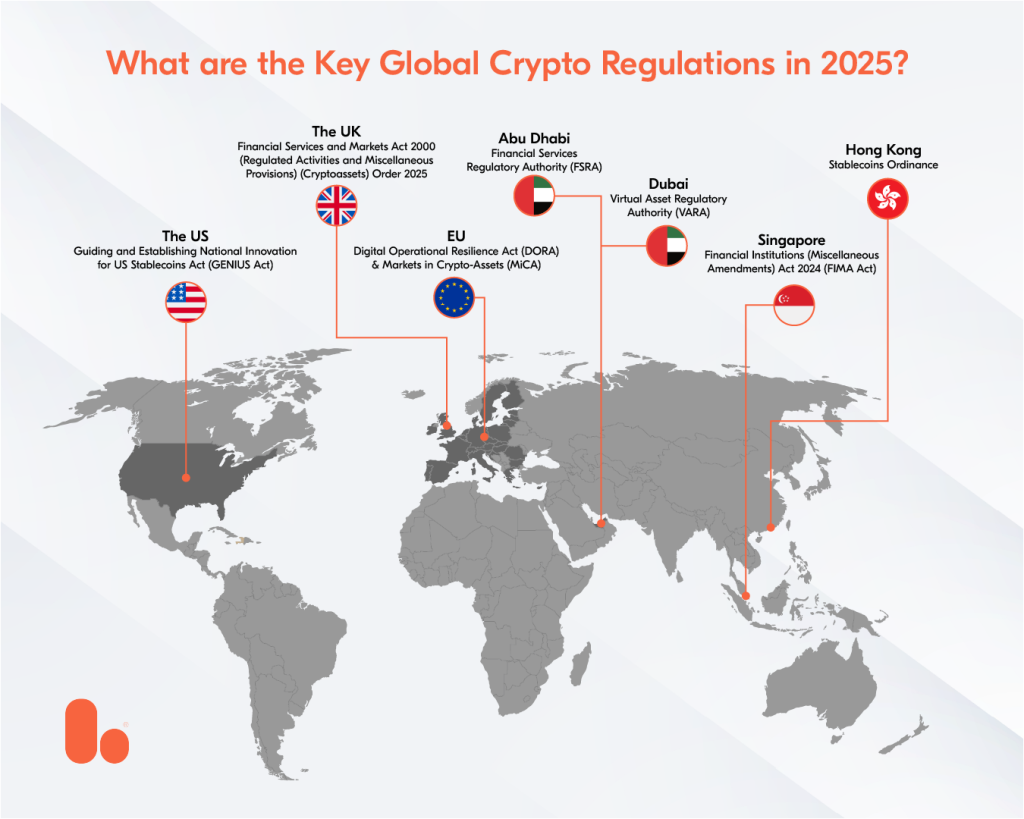

The landscape of cryptocurrency is rapidly evolving, driven not just by technological advancements but also by global regulatory trends. As governments and financial authorities around the world grapple with the implications of digital currencies, it's essential to stay informed about the shifting regulatory environment. Key trends include increasing scrutiny on initial coin offerings (ICOs) and the implementation of anti-money laundering (AML) regulations. Countries like the United States, the European Union, and China are taking significant steps that may set the tone for global practices. This means that businesses and investors in the cryptocurrency space must adapt to these changes, ensuring compliance to avoid legal pitfalls.

One of the most notable developments in global regulation is the push for greater transparency and consumer protection. Regulatory bodies are focusing on measures that enhance the legitimacy and security of cryptocurrency transactions. For example, the Financial Action Task Force (FATF) has introduced guidelines aimed at tracking and reporting cryptocurrency transactions to prevent illicit activities. Additionally, many countries are looking to establish clearer tax policies regarding cryptocurrency gains. By understanding these global regulatory trends, stakeholders can better navigate the complexities of the market and make informed decisions while fostering a more secure environment for digital assets.

Are Stricter Regulations a Threat or Opportunity for Crypto Investors?

The ongoing debate surrounding cryptocurrency regulations has intensified, with opinions divided on whether stricter regulations pose a threat or an opportunity for crypto investors. On one hand, increased regulation may create a challenging environment, as it could lead to greater scrutiny and compliance burdens for crypto projects and exchanges. Some investors fear that this could result in diminished market volatility and fewer opportunities for profit. However, these regulations can also pave the way for a more stable and secure investment landscape, as they aim to protect consumers and prevent fraud. This could ultimately increase mainstream adoption and instill greater confidence among traditional investors.

On the flip side, stricter regulations can be seen as an opportunity for investors willing to adapt to the changing landscape. By promoting transparency and lawful operation, regulations could eliminate many of the fraudulent schemes that have plagued the industry, leading to a healthier market. According to some analysts, clear regulatory frameworks could encourage institutional investment, further legitimizing cryptocurrencies as an asset class. Therefore, while the path may become more regulated, the long-term prospects for crypto investors may benefit from a more structured and secure ecosystem that prioritizes investor protection and boosts overall market integrity.