BJ255 Insights

Exploring the latest trends and news in various fields.

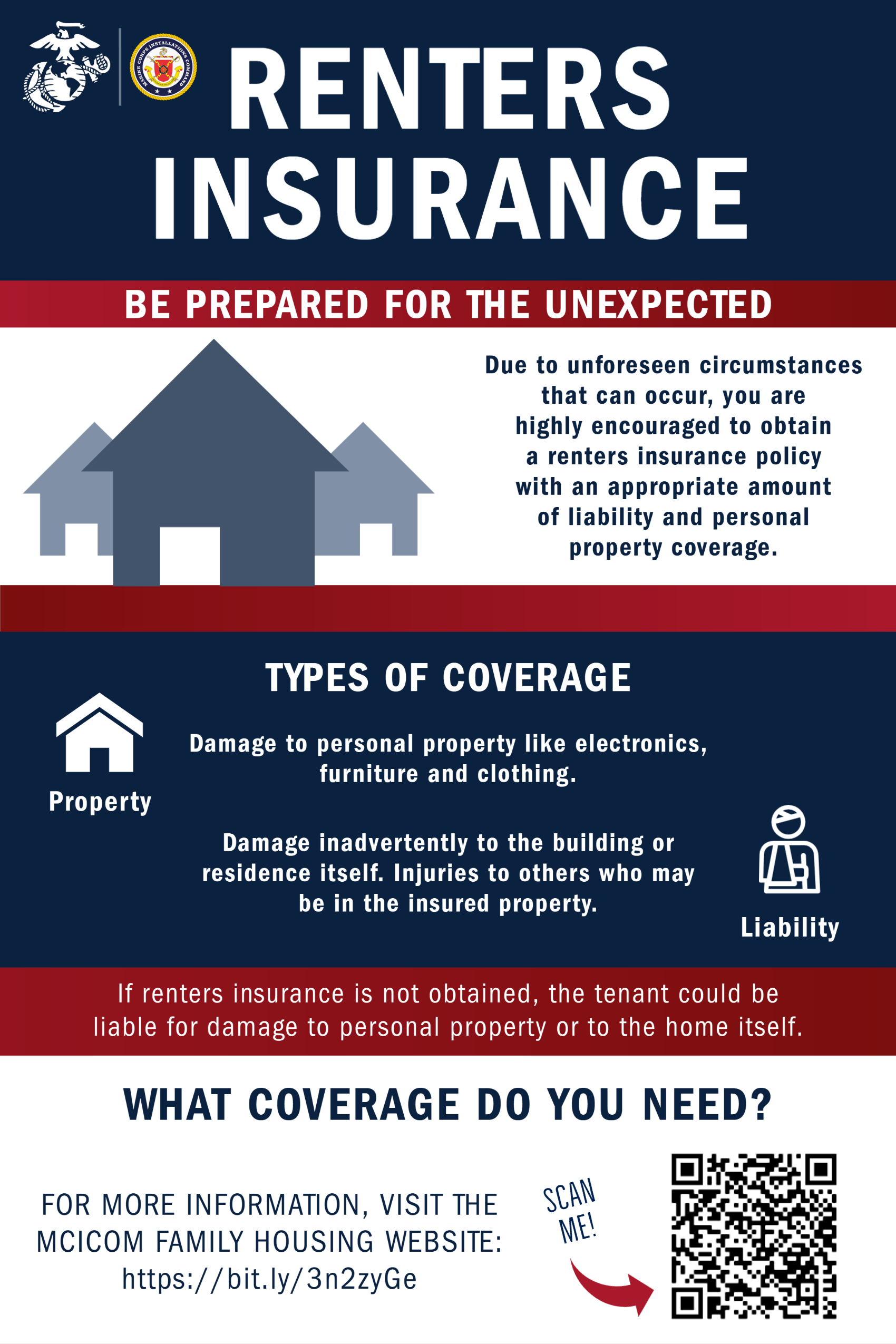

Renters Insurance: Your Safety Net in a World Full of Unforeseen Events

Discover how renters insurance can protect your belongings and give you peace of mind in an unpredictable world. Don't wait—secure your safety net today!

What Does Renters Insurance Cover? A Comprehensive Guide

Understanding renters insurance is crucial for anyone renting a home or apartment. This insurance protects your personal belongings in the event of theft, fire, or other disasters. Key coverages typically include protection against loss or damage to personal property, liability coverage if someone is injured in your rental unit, and additional living expenses if you need to temporarily relocate due to a covered loss. For instance, if your laptop is stolen or your furniture is damaged in a fire, your renters insurance policy can help you recover those financial losses.

Moreover, it’s important to note that renters insurance generally does not cover structural damage to the property itself, as that is the landlord's responsibility. However, many policies may offer coverage for certain types of personal liability, medical payments for guests, and even additional coverage for specific valuables like jewelry or electronics. Always read your policy thoroughly and consider discussing your needs with an insurance agent to ensure you're adequately covered. Understanding the nuances of what your renters insurance covers can help you make informed decisions and protect your belongings effectively.

7 Reasons Why Renters Insurance is Essential for Every Tenant

Renters insurance is often overlooked by tenants, yet it provides essential protection that can save you from significant financial loss. One of the primary reasons to invest in renters insurance is that it covers your personal belongings in the event of theft, fire, or natural disasters. Without this coverage, you may need to bear the full cost of replacing your valuable items out of pocket. Additionally, many landlords require tenants to have renters insurance, making it a crucial element for securing your living space.

Furthermore, renters insurance offers liability coverage that can protect you in case someone is injured while visiting your home. If a guest slips and falls, for instance, having insurance can help cover legal fees and medical expenses, saving you from potential financial strain. In essence, renters insurance not only safeguards your possessions but also provides peace of mind, allowing you to enjoy your home without the constant worry of unforeseen circumstances.

How to Choose the Right Renters Insurance for Your Needs

Choosing the right renters insurance is essential for protecting your personal belongings and ensuring peace of mind while living in a rental property. Start by assessing your needs: make a list of your valuable possessions, including electronics, furniture, and clothing. This will help you determine the amount of coverage you require. Additionally, consider the location of your rental unit, as certain areas may have a higher risk of natural disasters or theft, which could affect your premium. Comparing quotes from different providers is crucial in finding the best plan tailored to your needs.

Once you have gathered quotes, pay attention to the coverage types offered. Most policies include personal property coverage, liability protection, and additional living expenses in case your rental becomes uninhabitable. Make sure to look for optional add-ons as well, such as coverage for high-value items or identity theft protection. Carefully read the terms and conditions to understand any exclusions that may apply. By evaluating these factors, you can confidently choose the right renters insurance that meets your lifestyle and budget, ensuring you are well-protected.