BJ255 Insights

Exploring the latest trends and news in various fields.

Insurance Showdown: Finding Your Perfect Policy Match

Unlock the secrets to the perfect insurance policy! Discover tips, comparisons, and more in our Insurance Showdown blog.

5 Key Factors to Consider When Choosing Your Insurance Policy

When it comes to choosing the right insurance policy, it is crucial to consider several key factors to ensure you are making an informed decision. The first factor is understanding the coverage options available. Different policies provide different levels of protection, so it’s essential to evaluate what is included in the policy, such as liability coverage, personal property coverage, and additional features like roadside assistance. Examining these options will help you determine what best suits your needs.

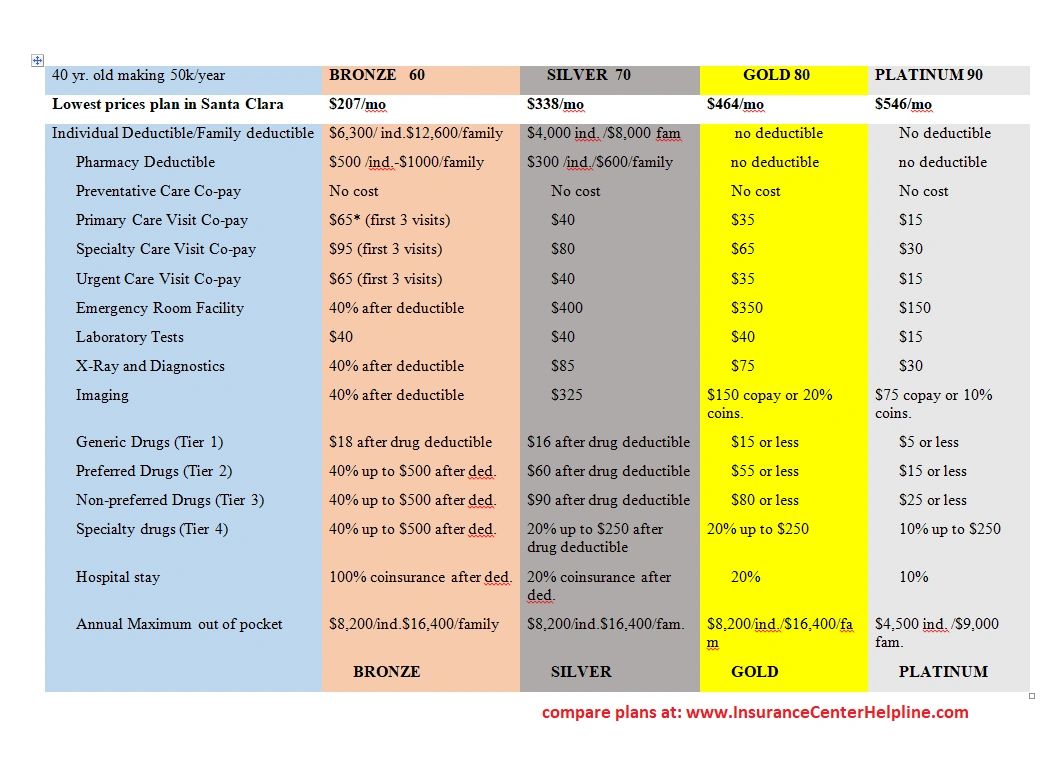

The second factor to consider is the premiums and deductibles associated with the policy. These are essential aspects that will affect your budget in the long run. Researching various options can provide insights into competitive pricing, and you can utilize comparison tools to understand how different providers stack up. Additionally, consider the financial stability of the insurance company; it’s vital to choose a company that can fulfill its obligations when you need it most.

Understanding the Different Types of Insurance: What Do You Really Need?

Choosing the right type of insurance is crucial for protecting yourself and your assets. There are several key types of insurance to consider, including health insurance, auto insurance, homeowner's insurance, and life insurance. Each type serves a specific purpose and can safeguard you against financial losses. For instance, health insurance covers medical expenses, while auto insurance protects against vehicle-related incidents. Understanding these categories is the first step toward making informed decisions.

To determine what you really need, assess your individual circumstances and potential risks. For example, if you own a home, homeowner's insurance is essential to protect against theft or damage. On the other hand, if you rent, renters insurance may suffice. Additionally, life insurance can be important if you have dependents relying on your income. A good rule of thumb is to evaluate your insurance needs based on your lifestyle, financial situation, and long-term goals, ensuring you have adequate coverage without over-insuring.

Is Your Insurance Policy a Good Fit? 7 Questions to Ask Yourself

Choosing the right insurance policy is crucial for protecting your assets and ensuring peace of mind. As you navigate through the myriad of options available, it’s essential to ask yourself, is your insurance policy a good fit? Start by considering your specific needs. For instance, evaluate whether the coverage limits are sufficient for your circumstances. Are you adequately covered for property damage, personal liability, and medical expenses? You should also think about how much insurance you really need, as this can vary widely depending on your lifestyle, assets, and risks.

Next, review the terms and conditions of your policy. Are there any exclusions that could leave you vulnerable? It's important to examine the deductibles; a higher deductible may lower your premium but increase your out-of-pocket expenses in the event of a claim. Additionally, ask yourself if you understand the claims process and what is required should you need to file one. For more guidance on evaluating insurance policies, consider checking out Consumer Reports. Lastly, consider your current financial situation; does the premium fit within your budget? By systematically addressing these questions, you'll be better prepared to determine if your current policy is indeed a good fit.