BJ255 Insights

Exploring the latest trends and news in various fields.

Auto Insurance Discounts: Where Savings Drive You Crazy

Discover insane auto insurance discounts that can slash your rates! Don't miss out on savings that make you go wild!

Unlocking Hidden Auto Insurance Discounts: What You Need to Know

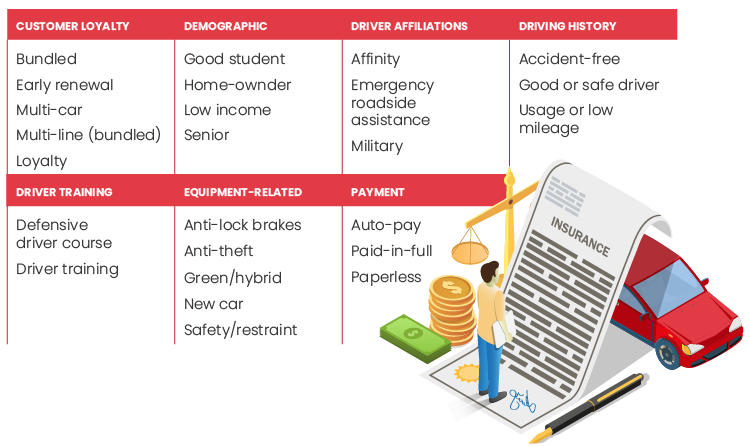

Auto insurance can often feel like a significant financial burden, but many drivers are unaware of the various hidden discounts that can help them save money. Insurers often offer a variety of discounts that are not always advertised prominently. For instance, discounts can be available for safe driving records, bundling multiple policies, or even for taking defensive driving courses. Insurance.com highlights how a clean driving history can lead to substantial savings, while Nationwide discusses the benefits of bundling insurance policies.

In addition to standard discounts, there are less common but worthwhile options to explore. For example, many insurers offer discounts for vehicles equipped with safety features like anti-lock brakes or backup cameras. Furthermore, some companies provide discounts for low mileage drivers or those who use telematics devices that measure and reward safe driving habits. Forbes provides a thorough overview of how these programs work and how policyholders can take advantage of them.

10 Common Mistakes That Could Cost You Auto Insurance Savings

Auto insurance can be a significant expense, but many drivers unknowingly make mistakes that can erode their potential savings. One of the most common blunders is failing to shop around for rates. Comparing insurance quotes from multiple providers is essential, as rates can vary drastically. A report from the National Association of Insurance Commissioners highlights that individuals who switch insurers can save an average of 15% on their premiums. Another frequent error is overlooking discounts that may apply to your policy. Many companies offer savings for safe driving, bundling policies, or even for simply being a good student.

Another mistake to avoid is underestimating the impact of your credit score on insurance rates. Insurers often use credit data to assess risk, meaning a lower score can lead to higher premiums. According to Consumer Financial Protection Bureau, maintaining good credit can help you qualify for better rates. Additionally, many drivers fail to update their policies as life circumstances change, such as moving, acquiring a new vehicle, or changing jobs. Keeping your insurer informed can ensure you're not paying for coverage you no longer need while also taking advantage of new discounts available based on your current situation.

Do You Qualify? Essential Questions to Ask About Auto Insurance Discounts

When considering auto insurance discounts, it’s essential to ask yourself some fundamental questions. First, do you know what discounts are available from your insurance provider? Many companies offer a variety of discounts based on factors like safe driving, multiple policies, or being a good student. Check with your provider or visit credible resources such as NIJ to understand the options that might apply to you.

Next, evaluate your eligibility for specific discounts. For example, inquire if you qualify for vehicle safety discounts by equipping your car with anti-theft devices or advanced safety features. Additionally, consider age-related discounts, as many companies provide lower rates for senior drivers or young drivers with clean records. A comprehensive guide on this topic can be found at Insurance.com, highlighting various qualifications for different discounts.